LTC Price Prediction: Assessing the Path to $200 Amid Technical and Fundamental Crosscurrents

#LTC

- Technical indicators show LTC trading below key moving average with mixed momentum signals

- Regulatory delays on ETF decisions create near-term uncertainty despite positive developments

- $200 target requires 77% gain from current levels, demanding substantial bullish catalysts

LTC Price Prediction

Technical Analysis: LTC Shows Mixed Signals Near Critical Moving Average

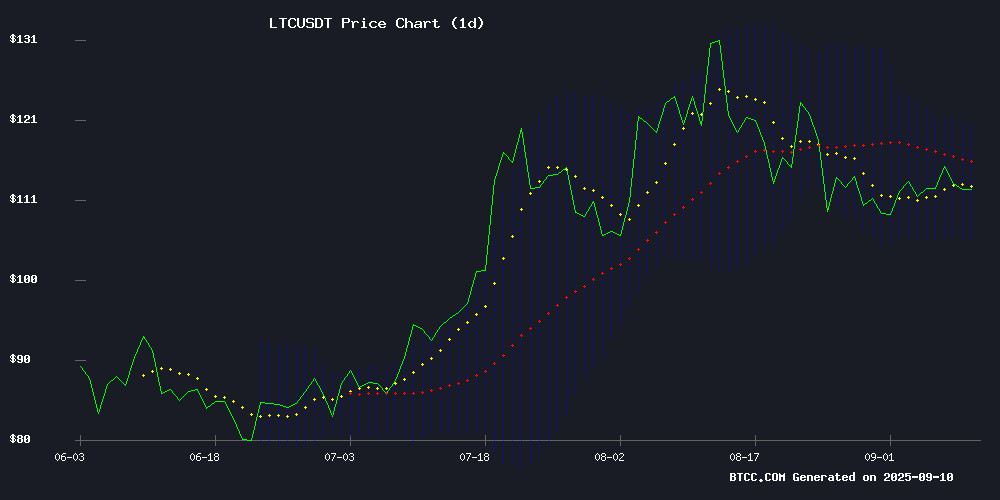

LTC currently trades at $112.99, slightly below its 20-day moving average of $113.10, indicating potential resistance at this level. The MACD reading of -1.42 suggests weakening momentum despite the bullish crossover potential. Bollinger Bands show price trading NEAR the middle band with upper resistance at $120.51 and lower support at $105.68, creating a relatively tight trading range.

According to BTCC financial analyst Emma, 'LTC needs to break decisively above the 20-day MA with volume confirmation to initiate a stronger upward move. The current technical setup suggests consolidation rather than explosive growth in the immediate term.'

Market Sentiment: Regulatory Delays Balance Positive Developments

Recent news presents a mixed picture for LTC. Positive developments include the Litecoin Foundation's privacy-focused wallet launch with MimbleWimble integration and price predictions targeting $125. However, regulatory headwinds persist with SEC delays on multiple crypto ETF decisions, including those affecting Litecoin-related products.

BTCC financial analyst Emma notes, 'While technological advancements and institutional interest through ETF filings provide long-term optimism, regulatory uncertainty continues to create near-term headwinds. The market sentiment remains cautiously optimistic but requires clear regulatory clarity for sustained bullish momentum.'

Factors Influencing LTC's Price

LTC Price Prediction: Litecoin Eyes $125 Target as MACD Turns Bullish - October 2025 Forecast

Litecoin shows signs of bullish momentum with a potential 10% upside to $125 by October 2025. The MACD indicator has flipped positive, suggesting growing buyer interest despite the current consolidation phase.

Technical analysts highlight the $125 level as a critical resistance zone. A breakout could trigger further gains, while failure may lead to retesting support near $100. Market sentiment appears cautiously optimistic as LTC stabilizes above its 200-day moving average.

SEC Delays Bitwise, Grayscale Crypto ETF Decisions Until November

The U.S. Securities and Exchange Commission has postponed its decisions on the Bitwise Dogecoin ETF and Grayscale Hedera ETF until November 12, 2025. The delay extends the review period for these altcoin-focused products, which were initially slated for earlier consideration.

Grayscale continues its push for broader crypto ETF adoption, filing to convert its Litecoin and Bitcoin Cash trusts into exchange-traded funds. This follows its successful conversion of the Bitcoin Trust, signaling a strategic expansion into alternative digital assets.

Market interest remains concentrated on XRP and Solana ETFs, with 92 crypto-related ETF applications currently pending SEC approval. The regulatory body appears to be aligning review timelines for multiple cryptocurrency applications, creating a synchronized decision-making process.

SEC Delays Grayscale's Hedera Trust Decision Amid Bitcoin Cash and Litecoin Filings Update

The U.S. Securities and Exchange Commission has postponed its decision on Grayscale's proposed Hedera Trust, setting a new deadline for November 12. The delay comes as Grayscale updates its filings for Bitcoin Cash and Litecoin trusts, both structured to list on NYSE Arca.

Grayscale's updated registration statements for Bitcoin Cash Trust and Litecoin Trust, filed on Form S-3, designate Bank of New York Mellon as administrator and Coinbase as custodian. The firm simultaneously submitted a Form S-1 for its Hedera Trust, which would trade under the ticker HBAR if approved.

These developments occur against a backdrop of over 90 pending crypto ETF applications before the SEC, including products tied to Solana and XRP. The regulatory body's cautious approach continues to shape the institutional adoption timeline for digital assets.

Grayscale Expands Crypto ETF Ambitions with Bitcoin Cash and Hedera Filings

Grayscale Investments has intensified its push into cryptocurrency exchange-traded funds, filing paperwork with the SEC for three new products tied to Bitcoin Cash (BCH), Hedera (HBAR), and Litecoin (LTC). The move comes as asset managers race to expand digital asset offerings following January's landmark approval of spot bitcoin ETFs.

The S-1 registration for a Litecoin ETF builds on Grayscale's existing LTC trust structure, while the S-3 filings for BCH and HBAR products represent entirely new market access points. These would join the firm's existing bitcoin and ether ETFs if approved, creating a diversified suite of crypto investment vehicles.

Regulatory uncertainty persists as SEC Chair Gary Gensler maintains cautious scrutiny of crypto products. The agency has delayed decisions on multiple digital asset ETF applications despite growing institutional demand. Grayscale's aggressive filing strategy—including yesterday's LINK Trust conversion request—signals confidence in eventual approvals.

Wall Street firms including Fidelity and VanEck are similarly positioning for broader crypto ETF authorization. Industry executives argue regulated products could bridge traditional finance and digital assets while addressing custody concerns that have deterred institutional participation.

Litecoin Foundation and AmericanFortress Launch Privacy-Focused Wallet with MimbleWimble Integration

The Litecoin Foundation has teamed up with AmericanFortress to unveil a new privacy-centric wallet, set for beta release in September. The wallet integrates Litecoin's MimbleWimble Extension Blocks (MWEB) and advanced C-filters to ensure untraceable transactions while maintaining blockchain validation.

David Schwartz, Project Director at the Litecoin Foundation, hailed the development as a milestone for privacy infrastructure in the crypto ecosystem. The wallet combines MWEB with FortressNames and enhanced C-filters to obscure transaction details and protect user IP addresses, offering a seamless experience akin to traditional finance apps.

MimbleWimble ensures transaction amounts and participants remain private, while C-filters prevent IP tracking on public servers. This dual-layer approach embeds privacy into the wallet's core functionality, positioning Litecoin as a leader in confidential transactions.

Pepeto Emerges as Viral Contender Amid Crypto Market Rally

Crypto investors are shifting focus to Pepeto (PEPETO), an Ethereum-based presale token blending meme culture with utility, as analysts project 25x growth potential. The token is outpacing established assets like Hedera (HBAR), Litecoin (LTC), and Bonk (BONK) in speculative interest.

HBAR's enterprise-grade technology, backed by Google and IBM, fails to offset its inflationary tokenomics. With 42 billion tokens circulating, its price action remains stagnant despite institutional adoption.

Litecoin, the decade-old 'digital silver,' shows diminishing relevance. Its failure to innovate beyond Bitcoin's shadow leaves traders seeking higher-beta alternatives as the bull market accelerates.

AI Accelerates Quantum Threat to Encryption, Posing Risks to Crypto and Global Finance

Artificial intelligence is dramatically accelerating the timeline for "Q-Day," the moment when quantum computers could break current encryption standards. Experts now warn this cryptographic doomsday may arrive by 2030, threatening the security foundations of blockchain technology, digital assets, and global financial systems.

The convergence of quantum computing and AI poses existential risks to RSA and ECC encryption—the mathematical bedrock securing cryptocurrencies and digital transactions worldwide. Deep learning models are solving quantum complexity problems that previously stalled progress, bringing functional quantum decryption capabilities closer to reality.

This development carries particular urgency for crypto markets. Blockchain networks relying on vulnerable encryption algorithms face potential compromise, while quantum-resistant cryptography becomes an immediate priority for developers and institutions.

Little Pepe (LILPEPE) Emerges as Dark Horse Amid Q4 Crypto ETF Rally

The fourth quarter of 2024 is shaping up to be a pivotal period for cryptocurrency markets, with ETF approvals driving institutional interest. While established assets like Solana (SOL), Litecoin (LTC), Dogecoin (DOGE), and XRP anticipate growth from potential ETF clearances, an under-the-radar presale token is gaining traction.

Little Pepe (LILPEPE), priced at $0.0021 in its 12th presale stage, has raised over $24.2 million with 15.17 billion tokens sold. The project's 96% sell-out rate suggests retail investor enthusiasm may outpace legacy cryptocurrencies during the coming ETF-fueled rally.

Bloomberg analysts assign high probability to SOL and LTC ETF approvals (95%), with XRP following at 85%. These developments could unlock institutional capital, though market saturation in billion-dollar ecosystems may limit upside compared to emerging tokens like LILPEPE.

Will LTC Price Hit 200?

Based on current technical indicators and market developments, reaching $200 appears challenging in the immediate future. LTC would need to gain approximately 77% from current levels, requiring significantly stronger bullish momentum than currently evident.

| Target Price | Required Gain | Current Technical Support | Key Resistance Levels |

|---|---|---|---|

| $200 | +77% | Weak | $120, $135, $160 |

| $125 (Near-term) | +11% | Moderate | $120 (Bollinger Upper) |

BTCC financial analyst Emma states, 'While $125 appears achievable based on current bullish predictions, $200 would require a fundamental shift in market conditions, regulatory clarity, and significantly increased institutional adoption. Current technical levels don't support such an aggressive move without substantial new catalysts.'